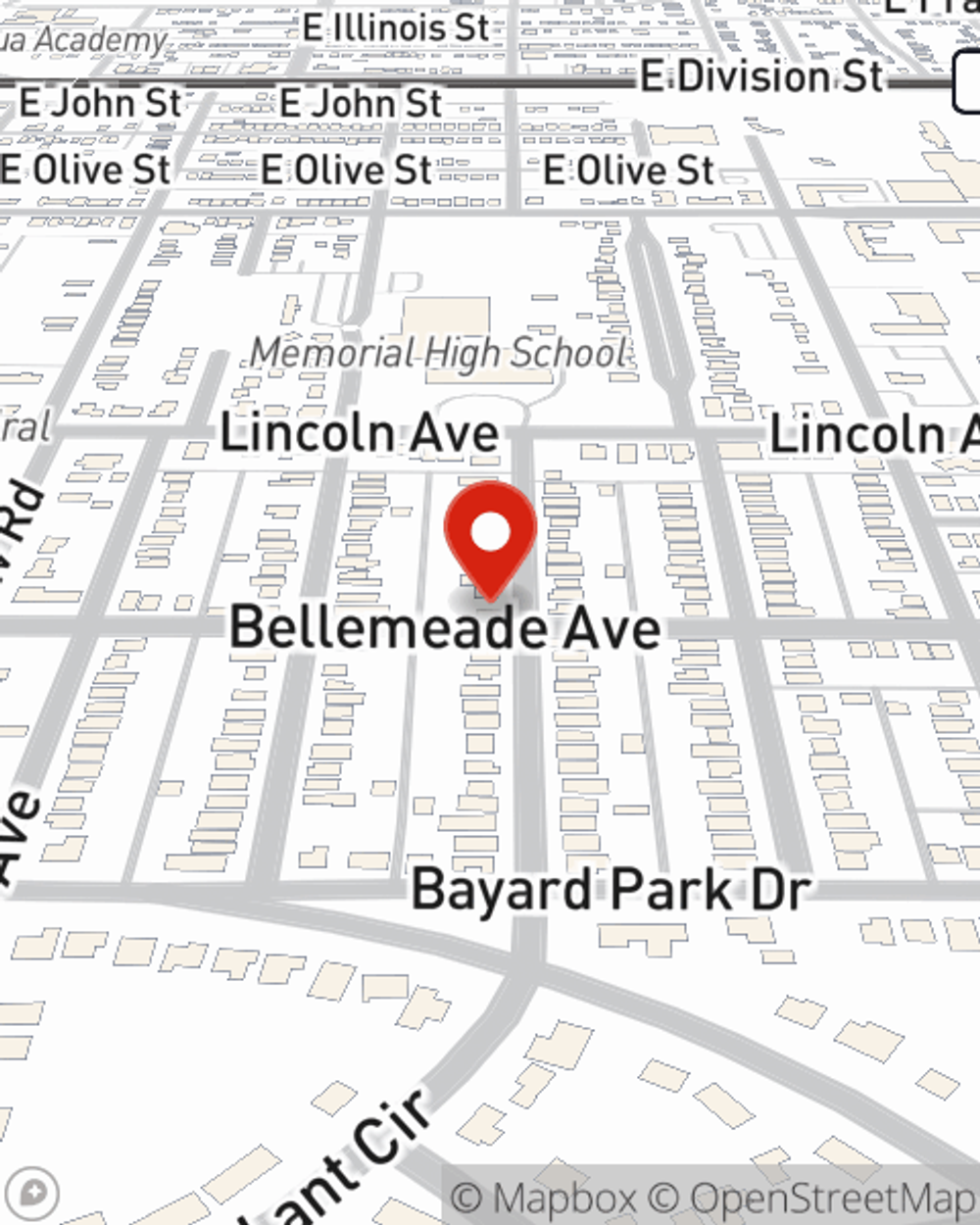

Business Insurance in and around Evansville

Get your Evansville business covered, right here!

Almost 100 years of helping small businesses

- Evansville, IN

- Newburgh, IN

- Boonville, IN

- Chandler, IN

- Mt. Vernon, IN

- Oakland City, IN

- Princeton, IN

- St. Joseph, IN

- Yankeetown, IN

- Haubstadt, IN

- Vanderburgh County

- Warrick County

- Posey County

Your Search For Remarkable Small Business Insurance Ends Now.

Running a business can be risky. It's always better to be prepared for the unfortunate problem, like a customer hurting themselves on your business's property.

Get your Evansville business covered, right here!

Almost 100 years of helping small businesses

Protect Your Business With State Farm

Planning is essential for every business. Since even your brightest plans can't predict consumer demand or natural disasters. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your future with coverage like extra liability and errors and omissions liability. Terrific coverage like this is why Evansville business owners choose State Farm insurance. State Farm agent Randy Robertson can help design a policy for the level of coverage you have in mind. If troubles find you, Randy Robertson can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and reach out to State Farm agent Randy Robertson to discover your small business insurance options!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Randy Robertson

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.